Portfolio Allocation#

In this quick tutorial, the portfolio allocation problem will be investigated. Of course, this is not financial advice in any way but should illustrate how multi-objective optimization can be applied to a quite interesting problem.

Let’s start by loading some data for illustration purposes. Feel free to use your own.

[1]:

import pandas as pd

import numpy as np

from pymoo.util.remote import Remote

file = Remote.get_instance().load("examples", "portfolio_allocation.csv", to=None)

df = pd.read_csv(file, parse_dates=True, index_col="date")

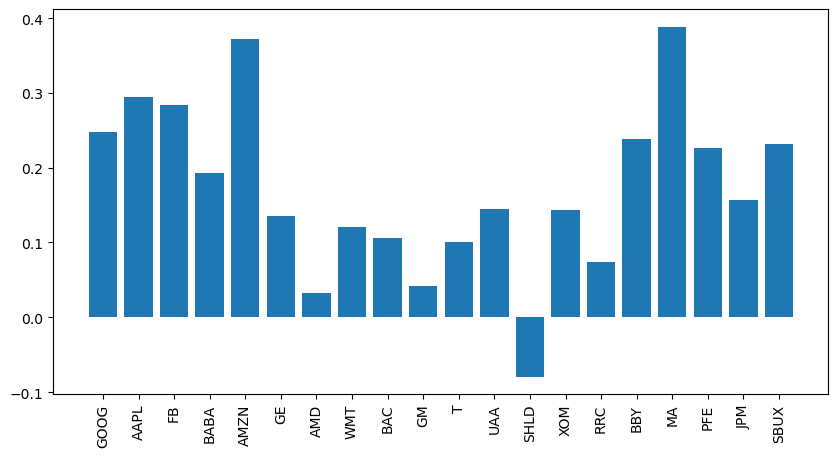

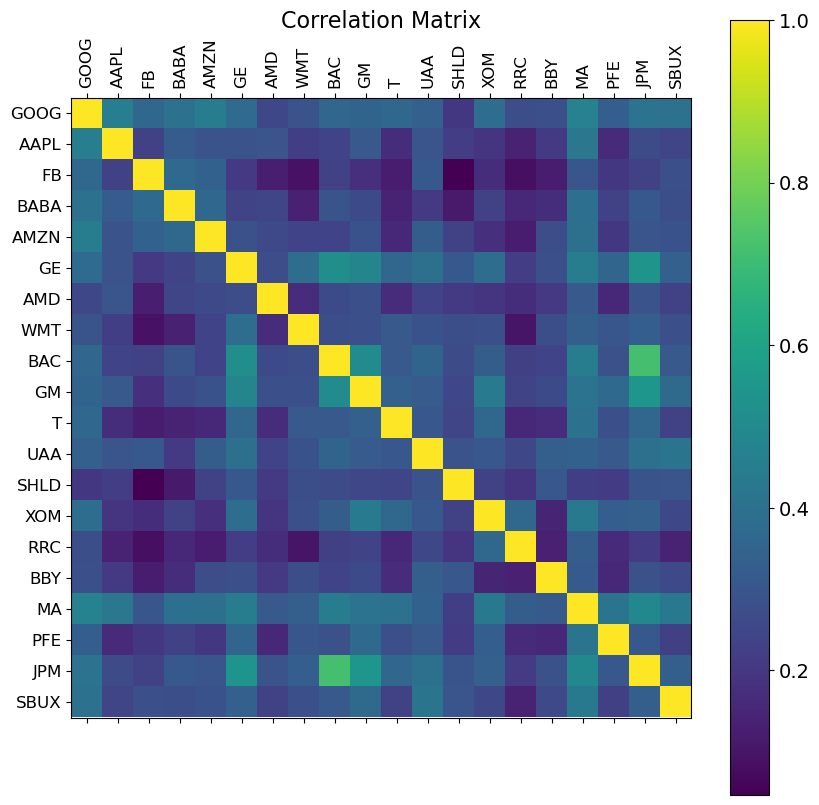

This tutorial is based on the Markowitz Mean-Variance Portfolio Theory and thus, we need to calculate the mean returns and covariances:

Info

Note that the problem in this case study can be solved directly using a quadratic solver (which will be much more efficient). However, such a solver finds only a single solution and must run multiple times to approximate the Pareto-optimal front. Moreover, it is worth noting that if we slightly change the problem to cubic or non-polynomial, it can not be applied anymore. The method shown provides more flexibility, for instance, optimizing objectives derived from Monte-Carlo sampling.

[2]:

returns = df.pct_change().dropna(how="all")

mu = (1 + returns).prod() ** (252 / returns.count()) - 1

cov = returns.cov() * 252

mu, cov = mu.to_numpy(), cov.to_numpy()

labels = df.columns

import matplotlib.pyplot as plt

fig, ax = plt.subplots(figsize=(10, 5))

k = np.arange(len(mu))

ax.bar(k, mu)

ax.set_xticks(k, labels, rotation = 90)

plt.show()

f = plt.figure(figsize=(10, 10))

plt.matshow(returns.corr(), fignum=f.number)

plt.xticks(k, labels, fontsize=12, rotation=90)

plt.yticks(k, labels, fontsize=12)

cb = plt.colorbar()

cb.ax.tick_params(labelsize=14)

plt.title('Correlation Matrix', fontsize=16)

print("DONE")

DONE

Then let us define an optimization problem based on the theory mentioned above:

[3]:

from pymoo.core.problem import ElementwiseProblem

class PortfolioProblem(ElementwiseProblem):

def __init__(self, mu, cov, risk_free_rate=0.02, **kwargs):

super().__init__(n_var=len(df.columns), n_obj=2, xl=0.0, xu=1.0, **kwargs)

self.mu = mu

self.cov = cov

self.risk_free_rate = risk_free_rate

def _evaluate(self, x, out, *args, **kwargs):

exp_return = x @ self.mu

exp_risk = np.sqrt(x.T @ self.cov @ x)

sharpe = (exp_return - self.risk_free_rate) / exp_risk

out["F"] = [exp_risk, -exp_return]

out["sharpe"] = sharpe

Now, we should consider one more fact. The variable x defines what percentage we will invest in what product. Thus, it can not be more than 100% in total. Moreover, an investment of a very small fraction does not really make sense. Thus we also incorporate each weight to be at least 1e-3 of the overall investment.

To ensure both, we can use a Repair operator (also see here) which will be directly used by the optimization method.

[4]:

from pymoo.core.repair import Repair

class PortfolioRepair(Repair):

def _do(self, problem, X, **kwargs):

X[X < 1e-3] = 0

return X / X.sum(axis=1, keepdims=True)

Now let’s see what solutions are found to be optimal:

[5]:

from pymoo.algorithms.moo.sms import SMSEMOA

from pymoo.optimize import minimize

problem = PortfolioProblem(mu, cov)

algorithm = SMSEMOA(repair=PortfolioRepair())

res = minimize(problem,

algorithm,

seed=1,

verbose=False)

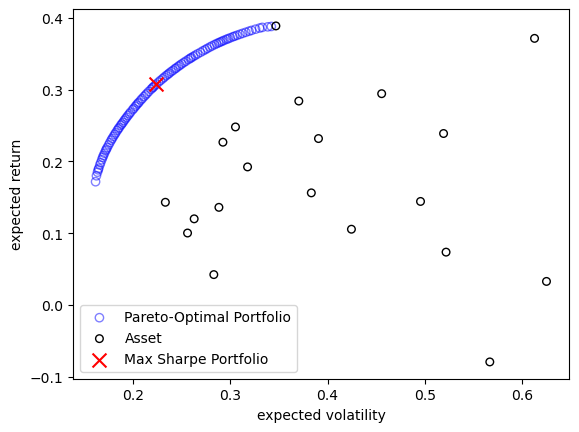

The algorithm has obtained a Pareto-optimal set trading off the mean return and volatility of the portfolio.

[6]:

X, F, sharpe = res.opt.get("X", "F", "sharpe")

F = F * [1, -1]

max_sharpe = sharpe.argmax()

plt.scatter(F[:, 0], F[:, 1], facecolor="none", edgecolors="blue", alpha=0.5, label="Pareto-Optimal Portfolio")

plt.scatter(cov.diagonal() ** 0.5, mu, facecolor="none", edgecolors="black", s=30, label="Asset")

plt.scatter(F[max_sharpe, 0], F[max_sharpe, 1], marker="x", s=100, color="red", label="Max Sharpe Portfolio")

plt.legend()

plt.xlabel("expected volatility")

plt.ylabel("expected return")

plt.show()

A common way for decision making is looking at the sharpe ratio shown below:

[7]:

import operator

allocation = {name: w for name, w in zip(df.columns, X[max_sharpe])}

allocation = sorted(allocation.items(), key=operator.itemgetter(1), reverse=True)

print("Allocation With Best Sharpe")

for name, w in allocation:

print(f"{name:<5} {w}")

Allocation With Best Sharpe

MA 0.3633135370150881

FB 0.2042576777647121

PFE 0.1955754252596654

AAPL 0.0674166417313004

BABA 0.06597072037334147

GOOG 0.05362214653118678

AMZN 0.04073000152704112

BBY 0.009113849797664655

GE 0.0

AMD 0.0

WMT 0.0

BAC 0.0

GM 0.0

T 0.0

UAA 0.0

SHLD 0.0

XOM 0.0

RRC 0.0

JPM 0.0

SBUX 0.0